Loan application is a common financial tool that Nigerians try to access for varying purposes. You may have heard of the local parlance, “I want an urgent 2k.” which is synonymous with needing urgent money. You’re in the right place to discover the top loan apps in Nigeria and their interest rates.

Over the years, Nigerians have been confused about the best path to ply to get a loan to pay bills, make an important purchase, and fund a business. This case has made most under-informed Nigerians to be between the devil and the deep blue sea – such that they often find themselves hooked in the tooth of troubles of loan sharks (unlicensed lenders).

Nigeria’s rising cost of living has sparked interest in finding effective ways to earn money online. Meanwhile, it’s important to note that many Nigerians turn to loans for their financial needs. This has led to the proliferation of different lenders that are offering loans at different interest rates. But this does not mean that there are no licensed lenders in the country. The Federal Competition and Consumer Protection Commission (FCCPC) has granted full approval and licenses to 78 companies operating as digital lenders in Nigeria. Also, there are 40 companies for which the commission gave conditional approval to operate in the same capacity. This brings the total number of approved lenders in Nigeria to 118 as of January 2023.

By being aware of this information, Nigerians can avoid the pitfalls of loan sharks known for their high-interest rates and strict timelines. You now have the freedom to select an FCCPC-approved lender. We have identified the top loan apps to assist you, providing insight into their interest rates.

Top Loan Apps In Nigeria And Their Interest Rates

1. Palmcredit

Palmcredit is a top loan app in Nigeria with over 5 million downloads on the Google Play Store. Palmcredit claims to offer a quick loan of up to N300,000 within a few minutes without requiring collateral. This is in line with the claim of the platform, where you can borrow an amount between N10,000 and N300,000, and complete documentation enables you to access the loan within a business day.

Palmcredit offers an Annual Percentage Rate (APR) that range from 24% to 56%.

For instance, if you plan to borrow N200,000 with a 6-month loan plan on Palmcredit, the platform charges an interest rate of 8% per month. This means that the interest rate for the 6-month duration is N48,000. Therefore, your total repayment will be N248,000.

2. FairMoney

There have been over 10 million downloads of FairMoney on the Google Play Store, with the claim that the platform offers fast loans (5 minutes) that are devoid of documentation or a need for collateral. The loan amount on this platform varies with your repayment history and smartphone data.

The amount of the loan ranges from N1,500 to N1 million with a repayment period between 61 days and 18 months at an interest rate for! 2.5% to 30%.

For instance, when you borrow a loan of N100,000 over 3 months, you will repay N130,000 at the end of the 3 months. You will be expected to repay N43,333 every month.

3. Okash

The Okash app has a record download of over 5 million, as mobile users in Nigeria can easily access it. This is a platform that Blue Ridge Microfinance Bank Limited is managing. Okash is always available to provide loans to its users.

The process of documentation on Okash is considerably fast. It provides loans ranging from N3,000 to N500,000 with a repayment plan between 91 and 365 days.

Okash interest rate is on daily calculation as its APR is between 36.5% and 360%.

4. QuickCheck

QuickCheck is notable for using machine learning to predict the behaviour of the borrower and examine loan applications immediately. This app currently has over 1 million downloads.

Loans from this platform are between N1,500 and N500,000, and it has interest rates that start from 5% on the first month of the loan. The repayment period here is from 91 days to 365 days with an interest rate between 2% and 30%.

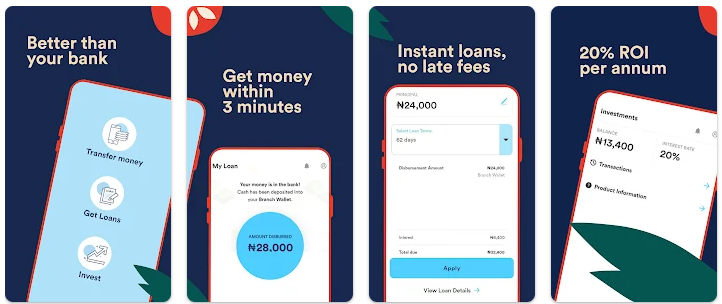

5. Branch

Branch is one of Nigeria’s most downloaded lending apps, with 10 million downloads on Google Play Store. Your smartphone data is the determinant of your eligibility for the loan on this platform.

Depending on your repayment history, you can get a personal loan between N2,000 and N500,000 within 24 hours. But the monthly interest rates on the app are from 3% to 23%, with a repayment period of 62 days to 365 days. But your access to the amount and interest rate is a function of your risk profile.

For instance, if you borrow N120,000 at an APR of 181% with a repayment period of 62 days on the app, you are expected to pay a total of N156,800, which is the interest rate of N36,800 added to N120,000.

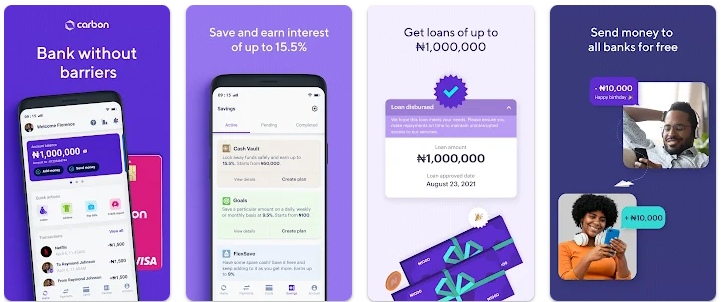

6. Carbon

Carbon is one of the leading digital banks in Nigeria that lend money to its users. This includes other financial services, like fund transfers, savings, investment, and credit scoring, that the platform provides. You can access both personal and business loans on Carbon as it claims to process loan applications in less than 5 minutes. The app has over 1 million downloads.

The interest rate on Carbon varies from 2% to 30%, and this is dependent on the amount you want to borrow, including the repayment period.

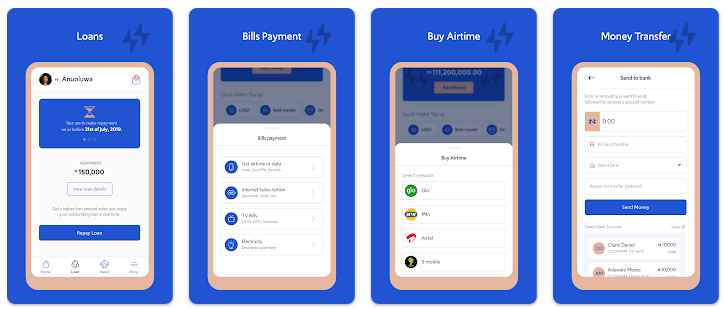

7. Aella Credit

Aella Credit offers quick access to loans without the requirement of a paper document. This app has over 1 million downloads and is available for download on Google Play Store and Apple Store. You can simply increase your credit limit by growing your credit score on the platform.

You can access loans that range from N2,000 to N1.5 million with a monthly interest rate between 2% and 20%, including an APR from 22% to 264% per annum. It has a repayment period of 61 days to 365 days.

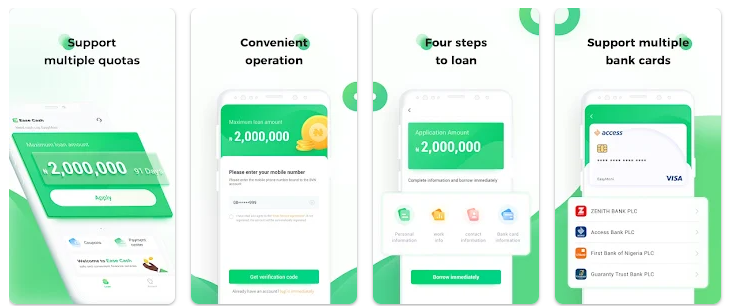

8. Ease Cash

Ease Cash is notable for being a reliable and safe loan app to get loans in Nigeria. It has over 1 million downloads and provides a quick loan that ranges from N1,000 to N100,000 for a repayment period of 91 days to 180 days.

This platform claims to charge a one-time processing fee (a minimum of 5% and a maximum of 20%) per transaction. But it has an APR of 14% for its loans.

9. Umba

Umba is another loan app with over 1 million downloads in Nigeria, although it boasts of being the leading digital bank in Africa. You can use the app from your smartphone or desktop computer.

You can borrow money between N2,000 and N30,000 with a maximum annual interest rate of 10%. But its repayment period is fixed at 62 days.

10. New credit

This loan app is known to offer loans as high as N300,000 without any collateral. Newcredit employs artificial intelligence to examine the financial records of its prospective users. This also includes their creditworthiness from other lenders.

Newcredit has over 1 million downloads, and you can borrow money between N10,000 and N300,000 at a fixed monthly interest rate of 4%. But its repayment period is from 91 days to 365 days.

Factors To Consider When Choosing A Loan App

1. Loan Duration

This is. The major factor that must inform your decision on choosing a preferred loan app. This underscores the knowledge of your ability to repay the money as and when due (as indicated on the app). If you need to borrow an amount of money that you can’t repay within 60 days, avoid apps with a fixed repayment period of 62 days and choose ones with longer repayment periods, up to 365 days.

2. App Usability

You must be able to find apt answers to the question, “Is the app easy to use.” Loan apps must be easy and simple to navigate with a user-friendly interface. But you may need to avoid such an app that is complex to use because you may not have a handy understanding of how the app works. A typical app must be easy for both beginner and advanced users.

3. Customer Service

We are talking about money here. Therefore, getting a good guide on your journey to applying for a loan is very important. Your preferred lender app must be able to have responsive customer service that you can easily and instantly contact to escalate a query and get resolved in the shortest time.

Frequently Asked Questions (FAQs)

Do I Need To Provide Collateral To Get Money From Loan Apps?

You don’t need to provide any collateral to borrow money from these lenders. You may need to provide your BVN or NIN details – enough for these online lenders to track the money they give you.

Are The Interest Rates Of These Loan Apps Lower Than The Rates Of Loan Sharks?

FCCPC regulates these aforementioned online lenders. Hence they are expected to operate within the interest rate framework given to them. Conversely, loan sharks are unregulated and not licensed. So they often give an interest rate that can be far higher than these loan apps.

How do Online Lenders use My Data To Process My Loan?

Loan apps use the data collected on your phone to help access your creditworthiness and enable fast processing of your loans. Also, they collect KYC (know your customer) data as directed by the Federal Government.

Conclusion

You can now get loans from any of the aforementioned lending apps, as each of them has its respective features, functions, and interest rates. You can carefully peruse them to infer the best option for yourself.

However, it should be noted that this article is not financial advice, and neither does it recommend any of the apps. This article is based only on our research, but you may need to study your preferred lending app more before borrowing money.