Venmo is a popular peer-to-peer (P2P) mobile payment service that enables users to send and receive money from around the world. This is a digital payment method that both individuals and businesses can use. But, as many business entities are adopting an online payment option such as Venmo to facilitate transactions, you may need to know how to set up a Venmo account for business.

What Is Venmo Business Account?

Venmo business account is the type of account that Venmo offers merchants to enable them to accept payments and make transactions via the Venmo app. This account suits entrepreneurs and small businesses seeking to accept payments from Venmo users.

This feature was launched in 2020 as part of the expansion of the payment service. As such, businesses can generate and send invoices to customers (Venmo users) and integrate with other e-commerce platforms to receive Venmo payments. This is similar to receiving PayPal payment through Flutterwave, which is one of the best payment gateways.

How To Set Up Venmo Account For Business

Step 1: Download the Venmo App

You can download the Venmo app for free on the Google Play Store or Apple Store. This mobile payment app is only available in the United States, so you will need a United States number to use the app. Alternatively, you can sign up for a Venmo account via its official website.

Step 2: Create A Venmo Business Account

You first need a Venmo personal account before creating a Venmo business account. So click “Business” and enter your phone number to receive a verification code that you will enter into the app. Provide your legal name and set your preferred email and password for the business account. Agree to Venmo’s User Agreement and Privacy Policy.

Step 3: Create Your Business Profile

Create your business profile by providing your business details. These are business name, business username, business description, business category, business address, and business profile image.

In addition, you must provide your legal name, birth date, address, SSN, or individual tax identification number (ITIN) for identity verification. You can optionally add your business website and contact information to your profile so new and existing customers can learn about your business.

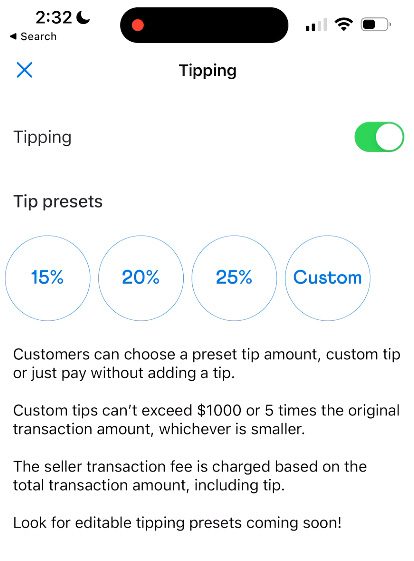

Step 4: Turn On Tipping (Optional)

You can turn on tipping on your homepage after creating your business profile. This works when the customer pays, as you can set the tip on your business account to 15%, 20%, 25%, or custom. But, your customers may also choose not to add any tip when paying you.

It is important to note that any tip added to the payment from your customers attracts a fee in addition to the seller transaction fee. This is 1.9% + $0.10 of the total transaction amount.

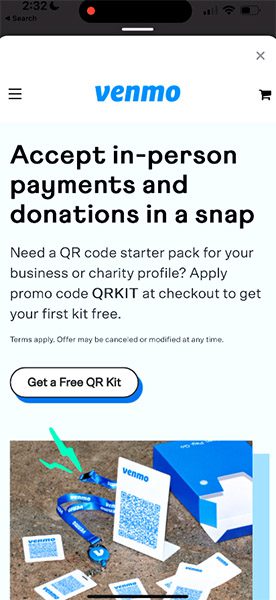

Step 5: Order A QR Kit (Optional)

Venmo’s QR kit is a helpful tool when you accept payments in person. The QR kit allows the easy display of your Venmo business profile so that customers can quickly scan it to make payments. The first Venmo QR kit is free, but the subsequent ones cost $14.99 each, which you can order from your Venmo business profile page.

Step 6: Add A Bank Account Or Card

You can add a bank account or card to your Venmo business account to enable you to send money to other Venmo accounts or withdraw your funds into the linked bank account or card. However, it is not essential to link your bank account to your Venmo account; you can still use Venmo without a bank account.

If your business profile is a sole proprietorship, you can use any bank account or card linked to your personal Venmo account to transfer funds to and from your Venmo business account. However, it would help if you linked to a separate

Here are the quick steps to link your bank account or card to your Venmo business account:

- Click the settings icon on your business profile page and choose “Payment Methods.”

- Select “Add a bank” or “Card.”

- You will be required to perform a bank verification, which can be achieved through instant or manual verification.

- Enter the card details (card number, expiration date, security code, etc.) to add a card.

Benefits of Venmo Business Account

1. More Payment Options

A Venmo business account enables you to offer multiple payment options for your customers. Therefore, Venmo users will find paying you for your products or services seamless through their Venmo balance.

2. Instant Fund Transfers

You can easily access funds from your Venmo business account via Venmo’s instant transfer option. This is ideal for small businesses that often need cash for operations or management.

3. Cost-Effective Payment Processing

Venmo’s transaction fees are generally lower than traditional payment methods – making the service cost-effective to process customer payments. Venmo charges transaction fees of 1.9% + $0.10, considerably lower than other popular business account providers.

Frequently Asked Questions (FAQs) About Setting Up Venmo Business Account

Is A Venmo Business Account Free?

Setting up a Venmo business account is free, as there is no monthly maintenance fee. But, the payment service charges 1.9% + $0.10 for every transaction.

What Is The Difference Between A Venmo Personal Account And a Venmo Business Account?

You can use a Venmo personal account to make peer-to-peer (P2P) transactions and send money to an authorized Venmo business account. Meanwhile, the business account enables you to receive payments for products and services.

Does Venmo Work Internationally?

No, Venmo is only available in US dollars for payments made in the United States. So, it may be advisable to create a PayPal account if you want to send or receive payments outside the United States.

Conclusion

Venmo continues to stay committed to making digital payment seamless by introducing a Venmo business account to help businesses of all sizes. It offers an additional payment option and low transaction fee for businesses to receive customer payments.

However, it is important to research how sustainable this option will be for your business before its integration.