Payment gateways are revolutionizing the way we transfer and receive money. This is because they are efficient and convenient to use. Venmo is one of these payment methods that enable you to make online transactions across the world. But as most transactions involve a bank account, you can actually send money without a bank account on Venmo. As interesting as this might sound, you must know how to add money to Venmo without a bank account.

What Is Venmo?

Venmo is a peer-to-peer (P2P) mobile payment service (owned by PayPal) that facilitates money transfers between friends and contacts. It provides a digital wallet that allows you to store your account balance. So, businesses and individuals can use Venmo to make and receive payments similarly to their local bank account.

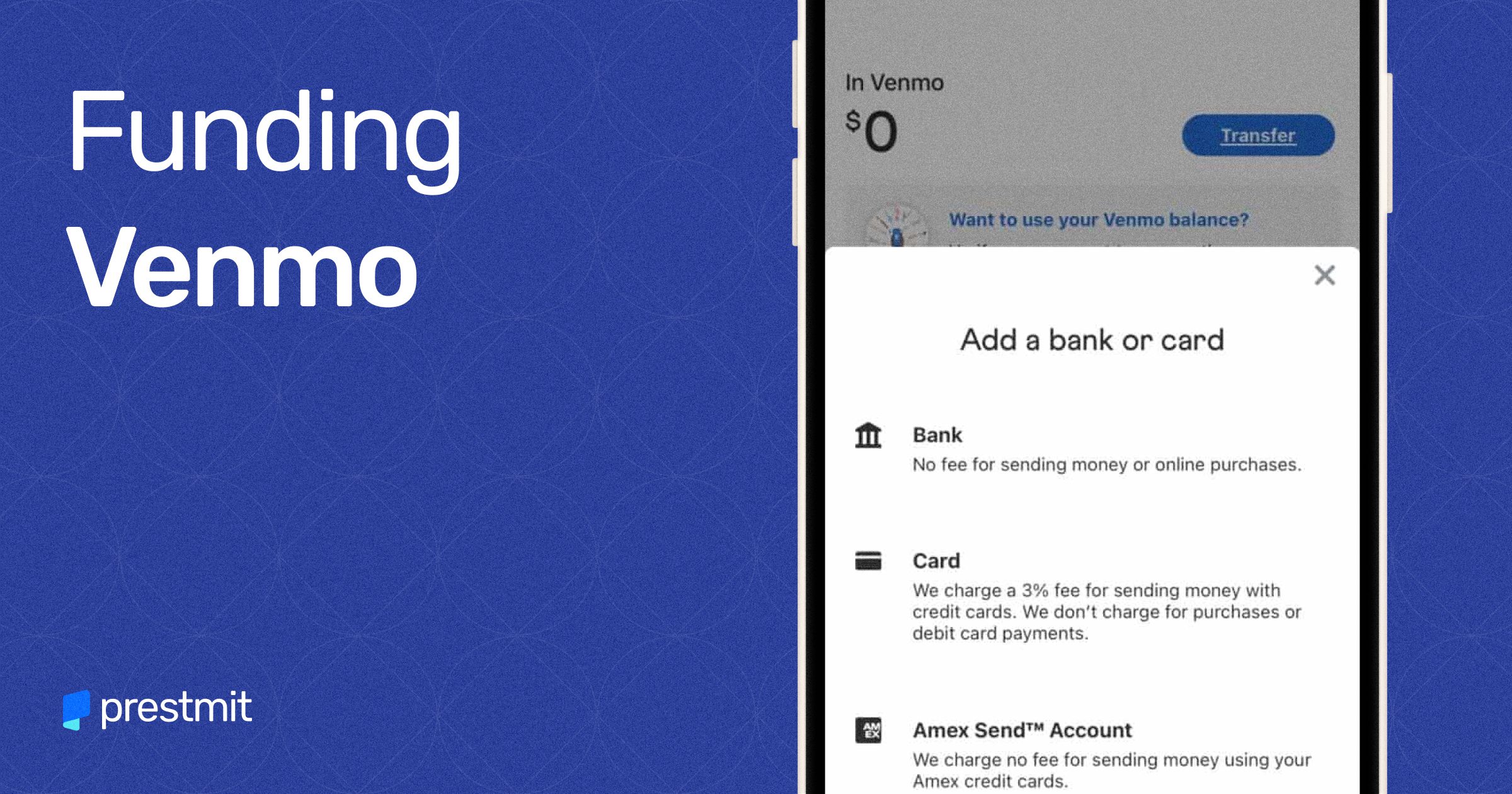

While you can use Venmo by adding your bank account to it, the platform is also available for users who do not have a bank account. So, irrespective of your category, you can effectively fund your Venmo balance to make payments like buying Bitcoin or other products and services.

This is with the understanding that some fragment of the global population remains unbanked. Still, a payment service such as Venmo drives financial inclusion in making money transfers accessible to all.

Ways To Add Money To Venmo Without Bank Account

There are different ways to fund your Venmo balance without a bank account. These are:

- Venmo direct deposit

- Cash a check service

- Ask a friend

1. Venmo Direct Deposit

You can directly deposit funds into your Venmo account balance through the following steps:

- Open the Venmo app on your desktop or mobile app.

- Navigate to “Settings” to choose the “Direct Deposit” option.

- Choose “Show Account Number” to copy “Account Number” and “Routing Number.”

- Paste all the details in the Direct Deposit Information form.

- Upon completing this process, direct deposit on your payment account would have been enabled so people can deposit money directly into your Venmo account.

2. Check Deposit

This is another good step to fund your Venmo account balance without linking to your bank account. Here are the steps to do this:

- Open your Venmo account on the web or mobile app.

- Click “Manage Balance” and navigate to choose “Cash a Check.”

- You will be directed to a page requiring you to enter the amount you want to add or deduct.

- You need to e-sign the check to continue this process.

- Submit clear photos of both sides of the signed check.

- Choose how soon you want to be able to access your money.

- If your check is approved, you will be asked to mark the front “VOID” and upload another photo to prove it has been voided.

- Your fund transfer will be processed, with the cheque taking between seven (7) and ten (10) days to be cleared and shown in your Venmo account balance.

3. Ask A Friend

You can give someone like a friend or family member cash and have them send money to you on Venmo. This will immediately be reflected in your Venmo account balance. As simple as this process can be, it may not be reliable. This is because you need to find a Venmo user before receiving money from them and adding it to your account.

Therefore, this is not recommendable as it requires you to have someone you can trust, or there could be a risk of scam.

Frequently Asked Questions (FAQs) About Funding Venmo Accounts

Can I Use Venmo Without A Bank Account?

Yes, you can use Venmo without a bank account. This is by linking a credit or debit card to your account.

How Long Does It Take To Fund My Venmo Account?

This depends on how you add money to your Venmo account. If you use instant transfers that send money from one Venmo account to another, your account will be funded immediately. However, using a “Cash a Check” can take up to ten (10) days to reflect on your Venmo balance.

Can I Add Money To My Venmo Card Without A Bank Account?

You can only add money to your Venmo card with a bank account.

Conclusion

Venmo is upholding the great role that payment gateways play in driving financial inclusion. This is due to its ability to enable users to add money to Venmo without a bank account – making online payments accessible to all.

However, it is essential to note that funding your Venmo account balance is fast when you receive payment from another Venmo user or by using a Venmo debit card.