Random guess: you’re a Nigerian offering a service online to a global or international audience, and you need PayPal to send and receive payments. Well, good news: you can learn how to open a PayPal account in Nigeria today!

PayPal is a world-renowned payment platform that lets users securely send and receive money across the world. Although it’s easily accessible in many other countries, it has proven difficult and almost impossible for Nigerians due to some differences. But there’s a method to it.

In this guide, we’ll walk you through the process of setting up your PayPal account in Nigeria.

Ready? Let’s get right to it.

Understanding PayPal in Nigeria

PayPal in Nigeria does not differ so much from PayPal worldwide. However, there are little variations in the creation of accounts on the platform if you’re a Nigerian.

Why does this variation exist? Nigeria is one of the countries partially banned from receiving money from other PayPal users from other nations. Some forums on Quora claim that it’s due to the many cases of fraud, with unscrupulous Nigerians using the payment channel to swindle unsuspecting foreigners.

PayPal is an online payment channel that was created in 1998 by Peter Thiel, Max Levchin and Luke Nosek. The platform has quickly become the most popular online payment channel, supporting 25 currencies and available in 202 countries.

But here are a few things to understand about how PayPal works in Nigeria.

- Eligibility

Resident Nigerians can create PayPal accounts. There are no restrictions stopping you from creating one. The only ban is on receiving payments with it.

- Currency

PayPal does not support Naira payments, so, you must link a USD or EUR bank account or card.

- Verification

You must verify your account to access the full functionality of your account.

So, what do you need to open a functional PayPal account in Nigeria?

Requirements for Opening a PayPal Account in Nigeria

To open a valid PayPal account in Nigeria, you must have the following.

- A valid email address

- A dollar card or domiciliary bank account in USD or EUR.

- A Nigerian phone number

Without these, you can’t successfully create a PayPal account in Nigeria.

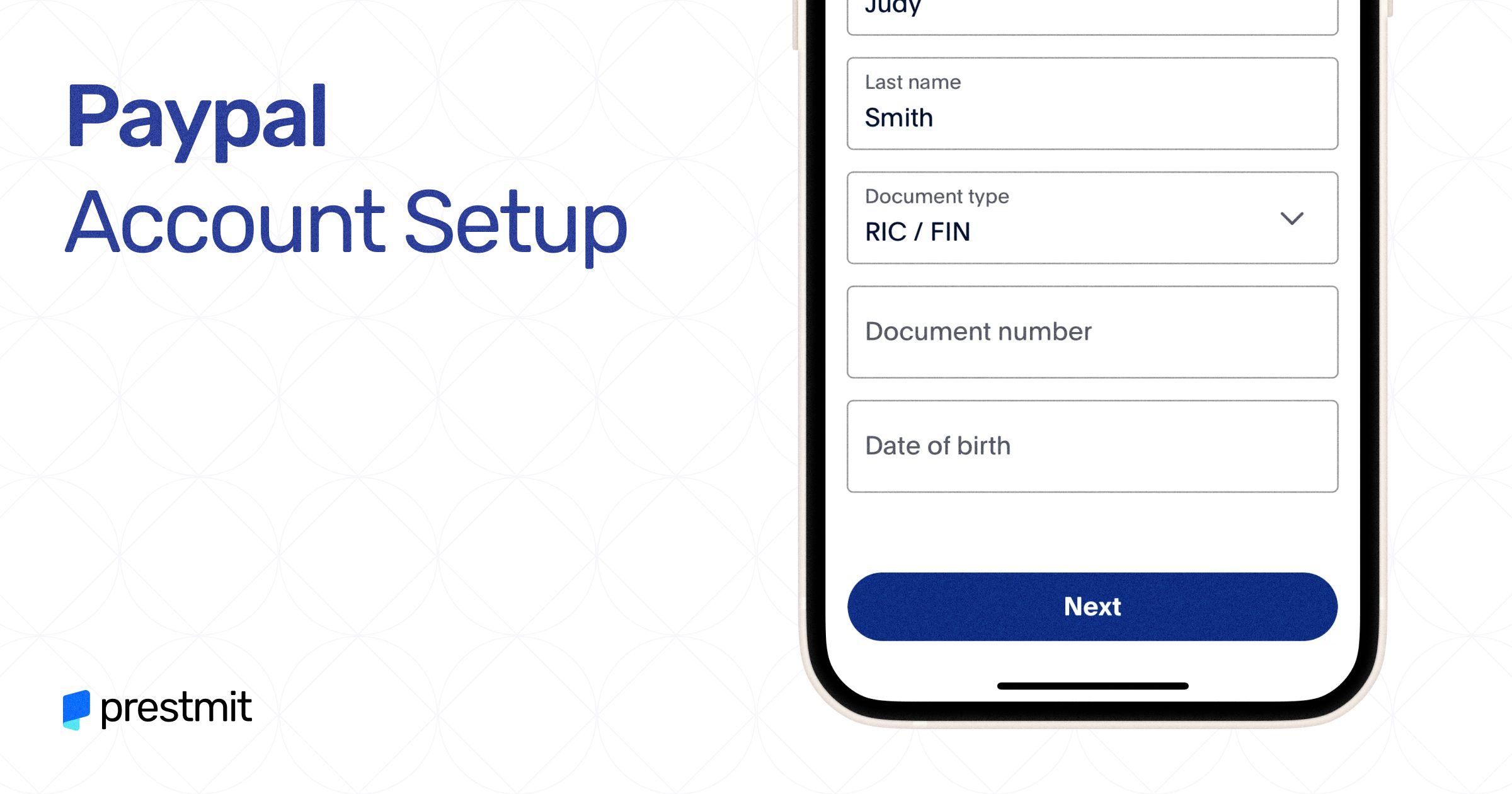

How to Create Your PayPal Account

Here’s a step-by-step guide on how to open a PayPal account in Nigeria.

- Go to the PayPal website and click Sign Up.

- Select the type of account you want. If you’re opening the account for business, select Business account. If it’s for personal use, select Personal account.

- Submit your personal information, including your full name, phone number, address, and email address.

- Verify your email address. Click the link in the email you’ll receive from PayPal to verify your email.

- Link your domiciliary bank account or dollar card. PayPal will initiate a transaction to verify that the account is active. Whatever money is deducted will be reversed afterwards.

- Confirm your phone number. As soon as you enter your Nigerian phone number, you can verify it by entering the code you’ll receive via SMS.

Now that you’ve created your account, you’ll need to verify it before carrying out transactions with it. Here’s how to go about it.

How to Verify Your PayPal Account

PayPal asks you to verify your account to prove that the financial details you provided are indeed yours. Verifying will also lift the restrictions placed on a newly created account. Of course, with Nigerian accounts, it’s different.

There are two basic things you need to do to verify your account.

- Add your account details. You can either link a bank account or a debit/credit card.

- Confirm the linked card or account.

Note: To confirm your bank account, PayPal will deposit tiny amounts of money into your account twice. You’ll need to check your account statement and enter the exact amount you see on PayPal. After the process is completed, PayPal will withdraw the deposits.

Using Your PayPal Account

After you’ve completed your account verification, you can then use your account to send money to other PayPal users, make payments online and receive payments.

Sending Money

You can send money to other users on PayPal with their mobile number or email address.

Buying Bitcoin

It may shock you but you can buy Bitcoin on PayPal. As soon as you’ve set up your account, all you need to do is to click on Finances when you log in and click on Crypto. Follow the prompts and pay with the account or card linked to your PayPal account.

Making Online Payments

You can use your PayPal account to make secure payments online. Whether you’re shopping or paying a subscription service, PayPal suits the payment purpose excellently. Most websites/merchants accept it as a means of payment. All you need is to link a working debit/credit card or a bank account.

You can also pay with gift cards on PayPal but the gift card must be an open-loop type like Mastercard, Visa or American Express.

Receiving Payments

Nigerian PayPal accounts are restricted from receiving payments. However, there is a caveat – business accounts can receive payment via their websites, but personal accounts can’t.

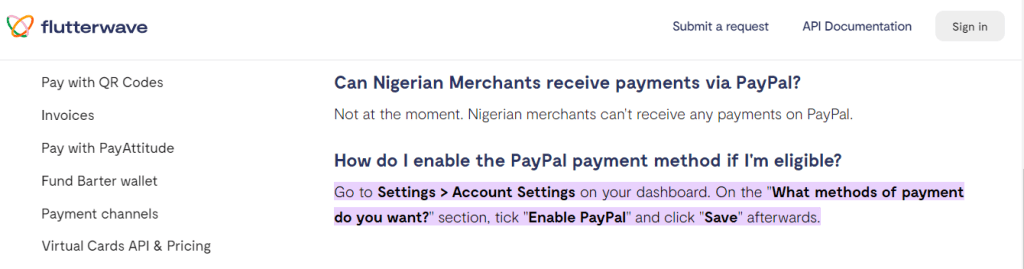

Receiving payments via PayPal in Nigeria is prohibited. But you can receive PayPal payments using Flutterwave, which is a third-party payment channel.

Quick Fact: Flutterwave is a payment too for merchants to send and receive money across the globe. It allows integration of payment channels like PayPal and was previously the only way to receive payments through PayPal in Nigeria. However, at the moment, this feature has been disabled indefinitely.

To Wrap Up

PayPal is a popular payment channel that has been in existence since 1998. Over the years, it has evolved to a world-leading online money transfer service. The service is available in most countries (about 202 countries) including Nigeria. That’s why we discussed how to open a Paypal account in Nigeria in this article.

One major fact to bear in mind about using PayPal in Nigeria is that you can’t receive payments, especially with a personal account. However, if you’re using a Business account, you can receive money through your website or integrate the PayPal API with other channels.

Remember to keep your account secure by using strong passwords and enabling two-factor authentication.