Cryptocurrency arbitrage is the practice of taking advantage of fluctuating exchange rates. Although cryptocurrency trading has been around for a while, the prices of cryptocurrencies can vary greatly from one crypto exchange to another, providing great opportunities for those who know how to maximise it. Anyone adept at keeping tabs on price fluctuations will know how to make money from cryptocurrency arbitrage.

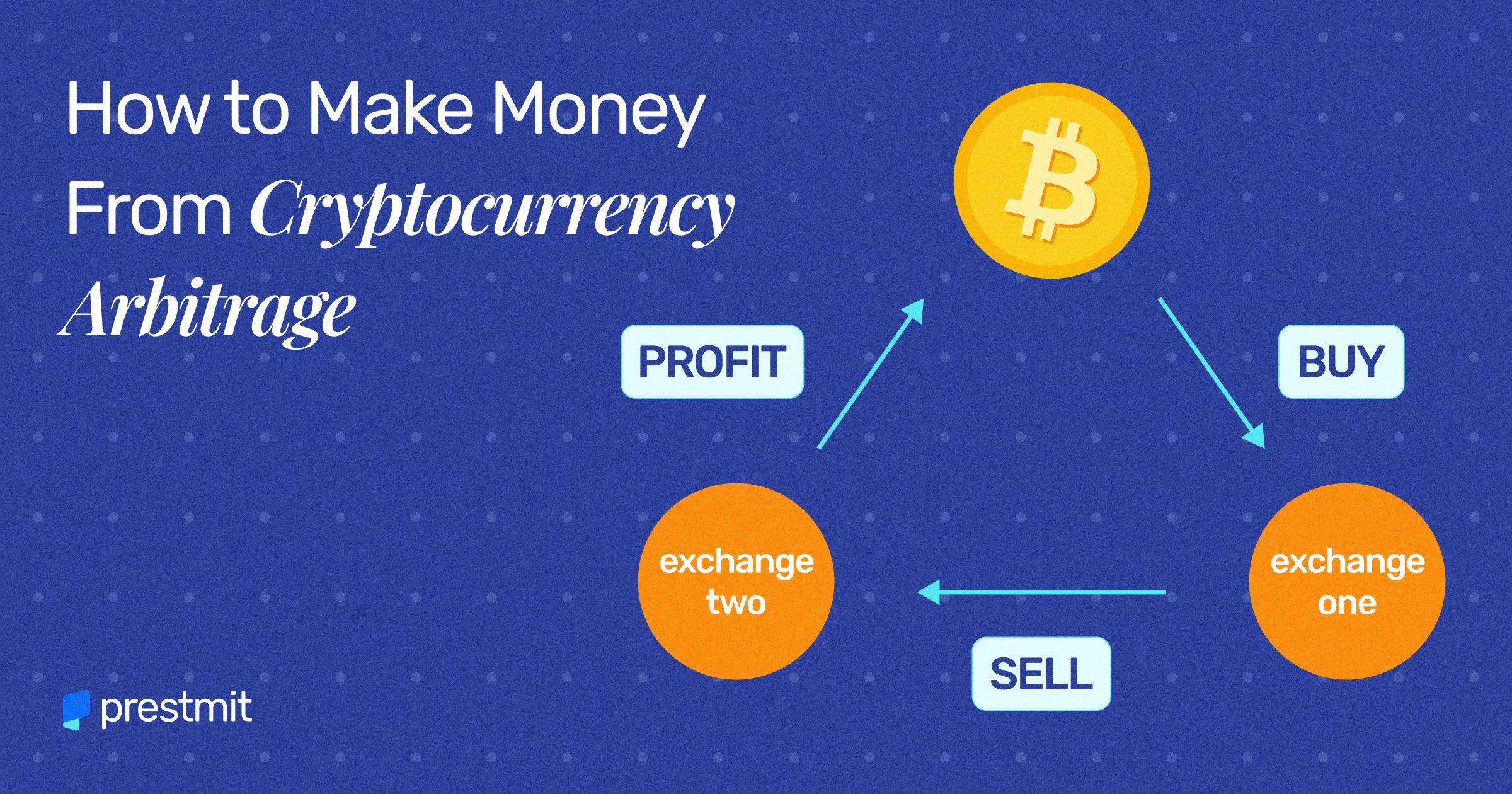

For various reasons, some cryptocurrencies are more valuable than others on different crypto exchanges. Arbitrage in cryptocurrency allows investors to profit from price discrepancies by purchasing cryptocurrency on one exchange and immediately selling it on another.

Investing in cryptocurrencies can be risky because of the volatility of the crypto market, which makes it difficult. It’s impossible to predict when prices will rise or fall. However, understanding price chart patterns can help you become an expert cryptocurrency trader.

Crypto arbitrage is a trading strategy that exploits market inefficiencies to help traders make money. However, in order to make a profit, these trades must be executed immediately; otherwise, the market may fluctuate, and you may incur a loss.

In this article, we will discuss how to make money from cryptocurrency arbitrage. Specifically, we’ll look at USDT arbitrage in Nigeria, how it works, and different approaches to making it profitable.

What Is Cryptocurrency Arbitrage?

Crypto arbitrage is a trading strategy that exploits market inefficiencies to help traders make money. Since the emergence of stocks, bonds, and foreign exchange markets, arbitrage has been a well-known concept. Trading the same asset on two different markets to profit from the price discrepancy is what it means to “hedge your bets.”

For instance, if Bitcoin (BTC) price is higher on Quidax than on Prestmit, you can simply buy your Bitcoin on Prestmit and sell it on Quidax to make some profits.

These price discrepancies may arise as a result of a sudden spike in trading volume or exchange inefficiencies. Prices set by larger trading platforms often influence smaller exchanges, but this does not always happen immediately, and that is arbitrage at its best.

Smaller crypto exchanges have to compete with larger ones to offer the same level of service. However, the smaller ones may be more stable because of supply and demand.

How Cryptocurrency Arbitrage Works

Due to the higher trading volumes at larger exchanges, prices of cryptocurrencies tend to fall. While the price of crypto-coins may be quite high on other exchanges with low trading volume.

For arbitrage, people have purchased cryptocurrencies on smaller exchanges and then sold them on larger exchanges. In 2017, a local Bitcoin exchange quoted the currency at a much higher rate than international exchanges.

When a crypto coin is listed on a well-known exchange like Prestmit, it is possible to engage in crypto arbitrage. When it comes to arbitrage, even geography plays a role, as it can be easier or more difficult to sell at different times of the day.

You need to be on the lookout for an opportunity to succeed at this. When an opportunity presents itself, you must seize it without delay. You can record in your order book how much money you’ll make by buying and selling on various platforms and then make a decision based on that information.

The transaction is confirmed within 15-20 minutes for the majority of major coins. Loss of arbitrage may occur if the market price falls during this period.

The volatile nature of the crypto market makes it difficult for arbitrage to occur simultaneously. It could take a few days to find the right time to execute a successful arbitrage deal. A single-side trade is one in which you buy a cryptocurrency but are unable to sell it arbitrarily.

Trading Strategies to Make Money From Cryptocurrency Arbitrage

1. Normal Arbitrage Trading

This is a well-known trading technique that is regularly employed by traders. All you have to do is buy a cryptocurrency at a low price and sell it to another exchange for a higher price. It’s the simplest form of arbitrage and is commonly used by many traders.

2. Decentralized Arbitrage Trading

This trading strategy is more complex, but luckily, it’s automated. You don’t have to do a lot of mental work yourself.

Automated market makers (AMMs) and distributed exchanges offer decentralized arbitrage trading as a common arbitrage opportunity. To determine the value of cryptocurrency trading pairs, it makes use of decentralized programs known as smart contracts.

3. Triangular Arbitrage Trading

In this arbitrage trading strategy, three cryptocurrencies are traded on the same exchange. For example, a trader can make more money by trading BTC, USDT, and ETH. It works when there are discrepancies in the prices of the three currencies. So, as a trader, you can sell BTC or exchange it for USDT and exchange the USDT for ETH. Then sell your ETH to buy back BTC.

Note that selling BTC or exchanging it for USDT may carry a profit. When you then take that profit and use it to acquire even more ETH, you may have just enough to buy more BTC than you had in the first place.

Triangular arbitrage trading is low-risk and low-profit most times, but it’s better than regular trading.

4. Statistical Arbitrage Trading

In this type of arbitrage trading, computational, statistical, and econometric techniques are all used in conjunction with arbitrage trading to achieve this result. For this kind of trading, the most important resources are trading robots and mathematical models.

How to Profit From Cryptocurrency Arbitrage In Nigeria

In the early days of cryptocurrency, trades were carried out by hand. But today, thanks to technological advancement, computerized trading has taken over. Now, price movements are tracked 24 hours a day, seven days a week, and trades are executed almost instantly. Consequently, arbitrage opportunities have been reduced as a result of the elimination of price errors that came with manual tracking and trading.

To profit from arbitrage trading, you’ll need different tools and technical knowledge, without which it’s practically impossible to make money from cryptocurrency arbitrage. You must be persistent and quick to take advantage of profitable opportunities. You should also have simultaneous access to multiple exchange listings to discern differences between them. Using arbitrage tools and software makes it much easier.

Day traders have more chances of making more profits. They buy cryptocurrency from one exchange and sell it on another. Day trading is the most common type of arbitrage that people engage in. However, it can be extremely ineffective at times.

At the time this article was written, the price of 1 BTC differs by $3 on two well-known cryptocurrency exchanges. Profits of 0.2% – 2.5% ($10 to $50) per day can be made by exploiting these kinds of discrepancies. A thousand dollars per week is possible if you focus on ten such spreads each day. When the spread is wider, the profit potential is much greater. In the above example, we only considered the case of spatial arbitrage. But in conjunction with other crypto arbitrage strategies, you could be making bank every week!

Buying from one exchange and selling it on another causes an increase in the price of the cryptocurrency, while arbitrage has the opposite effect. As a result, the next trader will find it more difficult to profit from arbitrage.

As long as the cryptocurrency exchange is open 24 hours a day, there is no way to stop it from happening. It is possible to buy and sell cryptocurrencies quickly using a crypto arbitrage trading not.

Pros Of Crypto Arbitrage

- Emerging crypto market

- Crypto volatility

- Fast profit

- Huge opportunities

Cons Of Crypto Arbitrage

- Fees

- Withdrawal limits

- Slow transactions

- KYC restrictions

- Competition

Conclusion

Cryptocurrency arbitrage, in the simplest terms, refers to taking advantage of price differences between exchanges or cryptocurrencies to make a profit. When there is a market inefficiency, there are numerous ways to profit from arbitrage techniques and opportunities. However, as more and more traders engage in arbitrage, these opportunities disappear as soon as they are created. This doesn’t mean you can’t earn from it. With the points and strategies discussed in this article, you will learn how to make money from cryptocurrency arbitrage.

Ensure you are adept at regular day trading before attempting other strategies. Remember to trade carefully and on trusted exchanges too.