Why should you invest in Bitcoin in 2024?

If you’ve had your eye on crypto for a while, you’ll probably ask yourself this question. The reasons range from new developments like the SEC approving spot Bitcoin ETF to the issue of Bitcoin halving. More on that in this article.

Bitcoin, the pioneer cryptocurrency, is currently the highest ranking in market cap and price. In 2021, Bitcoin peaked at $65,000 but crashed all the way to $13,000 during the 2022 bear run. In 2023, the market smiled again on those who HODL’d when it rose again to $45,000 at the end of the year.

In this article, we’ll discuss why you should invest in Bitcoin in 2024.

Ready to face facts? Go on.

Brief Look at Bitcoin’s Performance in 2023

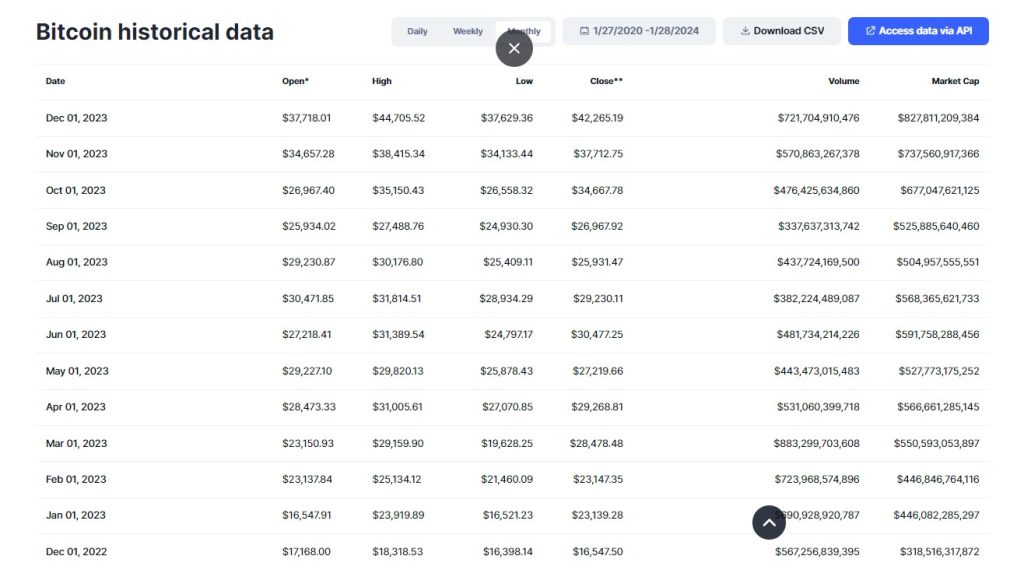

In 2022, Bitcoin went through a terrible bear run, hitting a low price point of $16,000 at the end of the year. In 2023, the market was in the cryptocurrency’s favour as the price gradually shot up from $16,603 to about $45,000 in December – a whopping 100%+ improvement.

Of course, these troughs and crests on the price chart were not arbitrary. Events such as the fall of the FTX exchange and the collapse of the Terra Luna in 2022 precipitated a crash in prices. Affected investors lost billions, leading to a rapid decline in price.

Other events, like the failure of the Silicon Valley Bank, had the opposite effect on the crypto market. Investors began discussions on the failure of traditional type banks to keep investments safe. While these discussions were ongoing, the attraction of decentralised finance and a peer-to-peer system of payments grew. Bitcoin suddenly looked like the next best thing, spurring an upward trajectory in its price point to $45,000 by the end of 2023.

In 2023, Binance came to a settlement with the US Treasury Department over the money laundering charges, and this event also impacted the crypto market.

Considering these changes between 2022 and 2023, why should you invest in Bitcoin in 2024? We’ll look at two major reasons.

Why Bitcoin Is Worth Buying in 2024

1. ETFs

Exchange Traded Funds, ETFs are a bunch of assets in one bundle traded by a company at an affordable price. An ETF combines different asset classes, like mutual funds, stocks and bonds, to make one super-diversified portfolio of assets that can be traded on the market anytime.

Just as stocks are traded on stock exchanges, ETFs are traded on exchanges, too.

How do ETFs work?

If you buy shares from 15 different companies and create a company, then begin to sell funds representing all your shares in those 15 companies, you’re selling an ETF. So, anyone buying $1 worth of your ETFs is buying $1 of the total cost of the shares from the 15 company shares they own.

Here’s a simple analogy to understand this better.

If you make a fruit mix of 10 different fruits and share the mix into bits whereby people can buy one plate of the mix each, you’re selling an ETF. They can trade that mix in the market where the individual fruits are usually traded.

Now, there are several types of ETFs, including Stock, currency, bond, commodity, and Bitcoin ETFs.

Bitcoin ETFs are either Derivatives ETFs (approved in 2021) or Spot Bitcoin ETFs just approved by the SEC in January 2024. It’s one of the reasons you should invest in Bitcoin in 2024.

What is a Spot Bitcoin ETF?

Spot bitcoin ETF is a kind of ETF that tracks bitcoin prices directly. The ETF buys and holds actual bitcoins in a highly secure digital vault and then issues shares to investors based on the market price.

Spot Bitcoin ETFs allow investors to have a share in Bitcoin and benefit from its price movements without actually owning Bitcoins.

So, this is now another avenue through which investors can have a very diversified portfolio, including cryptocurrency. They don’t have to handle private keys and crypto wallets or pay a crypto exchange to handle them. Although, the brokerage fees for spot bitcoin ETFs may be higher.

The move for the SEC’s approval of spot Bitcoin ETFs was spearheaded by the investment giant Blackrock. Some of the approved ETFs for spot Bitcoin ETFs in 2024 include the following

- ARK 21 Shares Bitcoin ETF (ARKB)

- Bitwise Bitcoin ETF (BITB)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Franklin Bitcoin ETF (EZBC)

- Grayscale Bitcoin Trust (GBTC)

- Hashdex Bitcoin ETF (DEFI)

- Invesco Galaxy Bitcoin ETF (BTCO)

- iShares Bitcoin Trust (IBIT)

- Valkyrie Bitcoin Fund (BRRR)

- VanEck Bitcoin Trust (HODL)

- WisdomTree Bitcoin Fund (BTCW)

You can read more on ETFs and Spot Bitcoin ETFs to better understand the concepts.

2. Bitcoin Halving and its Positive After effect

Bitcoin halving is another reason to invest in Bitcoin in 2024, and we’ll tell you why.

Bitcoin halving refers to the slash in Bitcoin mining rewards once every four years. Now, why would that be a good reason to invest in Bitcoin?

By mere logic, scarcity increases the worth of a thing. When there is a reduction in the amount of Bitcoin available as a reward for mining, the amount in circulation reduces, leading to scarcity.

Considering the history of price increases following every bitcoin halving, it’s only logical to jump on the investment opportunity if there’s a scheduled halving coming up.

And there’s a halving event scheduled for April 2024. Mining rewards will be reduced from 6.25BTC to 3.125 BTC.

If nothing else convinces you as being reason enough to invest in Bitcoin, this should do it.

Take a look at the price increase that has followed every halving event.

- 1st halving – November 2012 (Price before halving was $13. After halving, the price shot up to $1,152.)

- 2nd halving – July 2016 (Price before halving was $664. After halving, the price shot up to $17,760)

- 3rd halving – May 2020 (Price was $9,734. After halving, the price shot up to the highest ever the following year – $67,549!)

Note that the bull runs that took place after every halving came to a halt at some point because several other factors influence Bitcoin prices, such as market sentiment, demand, and other economic factors. However, the last three halving events have shown a clear pattern of definite upward shoots in price.

Conclusion

Bitcoin has remained the king of cryptocurrencies since its inception. Despite being the most volatile, it has also yielded good returns for investors with a high-risk appetite and knowledge of the market. In 2022, however, Bitcoin price crashed to a very low $16,000. Lots of investors lost a fortune. So why should you invest in Bitcoin in 2024?

Apart from the fact that 2023 was a good year for the pioneer crypto, two major factors indicate that the bitcoin market is in for a huge bull run in the coming months. The first is the approval of spot bitcoin ETFs by the US SEC. Investors know that this is a positive sign for Bitcoin. You can read more on the subject in this article.

The second reason is the bitcoin halving slated for April 2024. Yet another bright green light, this event always precedes a climb in Bitcoin price point. History proves this.

So, if you’re interested in grabbing your slice of the crypto cake, learn more about these investment opportunities. Ensure you research them thoroughly and seek the assistance of a broker if you’re relatively new to the investment space.