The popularity of cryptocurrency continues to increase with the steady growth in the adoption rate, even as more coins are introduced into the crypto market. But the banking and the financial world has recently had a feel of cryptocurrency innovations, with top cryptocurrency credit/debit card providers making crypto and fiat transactions seamless for crypto investors.

It is noteworthy that crypto credit/debit cards do not have a large pool. This is due to various banking restrictions some governments implement on crypto transactions.

While many of these cards are ideal for regular shoppers because of the cash back you earn for every purchase, a few of these prepaid cards enable you to earn interest from the crypto in your account. But almost all these cards enable you to convert cryptocurrency to fiat currency easily.

Then you can withdraw the fiat currency at the ATM, which you can use to pay for products and services at stores that accept Visa and Mastercard.

In this light, here are the top 10 cryptocurrency credit/debit card providers.

1. Crypto.com

Crypto.com supports the buying and selling more than 100 cryptocurrencies, with a global reach of over 10 million users as of July 2021. Users can use its metal prepaid Visa card to get up to 8% cash back when they use its Visa-supported card to spend cryptocurrency.

Aside from using crypto, you can also top up your card with fiat currencies – as Crypto.com supports fiat currencies.

You can use this prepaid card to spend cryptocurrency across 40 million Points of Sale (PoS), ATMs with Visa logos, and retail stores.

You can always top up this card with crypto and spend them in US dollars, just like other payment methods.

However, the card tier depends on the amount of CRO tokens you buy and deposit in your crypto wallet. Also, its users must complete KYC verification to increase the tier of their card.

Features:

- Mobile app is available

- Free ATM withdrawal of up to $1,000

- Spend the crypto card on Spotify, Netflix, Prime, and Airbnb

- Earn from 1% to 8% cashback for using the card to make payments

2. Gemini

This crypto card is available to global users and connected to MasterCard. Gemini assures real-time rewards when you buy Bitcoin or other cryptocurrencies on the platform.

This contrasts with other crypto cards that do not provide real-time purchase rewards.

For instance, you will get 2% cash back on groceries, 3% on dining purchases, and 1% on other purchases. You can top up 30 cryptocurrencies available on Gemini on your crypto card.

Features:

- Mobile app is available on Google Play Store and Apple Store

- Instant up to 3% cash back deposited into your Gemini account

- Provides 24/7 live agent support

- Available in silver, black, and rose gold metal cards

3. Coinbase

The Coinbase card is a plastic crypto debit card that allows users to spend cryptocurrencies in their portfolio and earn rewards for every purchase. You can spend your crypto anywhere with this card. Users can earn up to 4% cashback on every purchase with this card.

Features:

- Mobile app is available

- No annual, monthly, or sign-up fee

- About 4% cashback as crypto rewards for using the card

- Sophisticated security like two-step verification, PIN protection, and instant card freezing

4. Uphold

You can use Uphold to get a MasterCard debit card that you can use anywhere that accepts MasterCard. You can use this card physically and virtually to spend any crypto asset in your Uphold wallet. Here, you can use the card to trade cryptocurrencies, fiat, commodities, and precious metals.

Virtual card users can add this crypto card to their Google Pay or Apple Pay wallets to enable fast and safe payments. You will get a 4% cashback in Ripple (XRP) anytime you use this card to purchase.

Features:

- FCA regulated

- Customizable virtual card

- Available as a physical and virtual card

- Real-time analytics to track spending

- Get about 4% cashback in Ripple (XRP) for every payment

5. BlockFi

BlockFi credit card is a crypto card that works like a cashback card to earn rewards for spending your crypto and reinvesting the earned rewards.

This credit card can earn up to 2% APY when you keep stablecoin assets on your BlockFi Interest Account (BIA). But you can not convert your Bitcoin (BTC) rewards to other crypto assets.

Also, the rewards are not instant – meaning that you can not earn time in the event of a bullish price run for Bitcoin.

Features:

- Get 1.5% cashback in Bitcoin (BTC) for every purchase

- No credit score checks for qualification purposes

- Offers $250 in Bitcoin as a sign-up bonus for spending $3,000 within the first three months

- Allows to pay bills, buy, and withdraw any crypto in the form of fiat currency at any ATM that accepts Visa

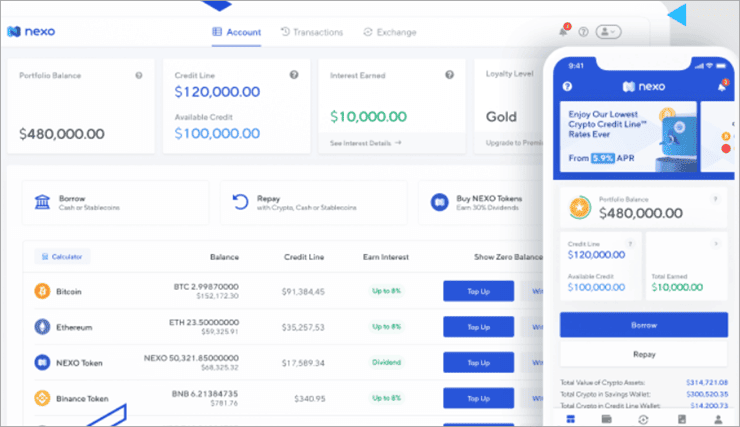

6. Nexo

The Nexo MasterCard crypto credit card allows users to take crypto loans of as much as $2 million on their crypto holdings.

Its users can secure and insure the loan with the crypto asset they hold in their wallets. This means that you are eligible to take a loan whose value is lesser than the value of your crypto holdings.

This crypto card supports over 20 cryptocurrencies.

Features:

- Can pay loan interest in crypto or fiat

- Get 2% cashback rewards on every purchase with the crypto card

- Mobile app is available On Google Play Store and Apple Store

- Create virtual cards for safe online use of the card

7. SoFi

This SoFi crypto credit card enables users to have cash back on purchases. Unlike other crypto credit/debit cards, the card supports only Bitcoin (BTC) and Ethereum (ETH).

Features:

- Get 2% cash back on every purchase with this card

- Earn $100 as a sign-up bonus for opening SoFi Money or Invest account

- Earn 2 points per $1 spent and redeem each point by depositing them into a SoFi account

- Lower APR by 1% when you make 12 monthly on-time payments when it’s due

8. Crypterium

Crypterium is a top crypto credit/debit card provider offering virtual and physical prepaid debit cards. You can use crypto from the Crypterium wallet to top this card.

Similar to other cards, you can use your Crypterium crypto card to convert crypto to fiat to pay for products and services at any location that accepts Visa.

This platform issues over 30,000 virtual cards, which you can get in minutes.

Features:

- Connects to Apple Pay

- Available in virtual, physical, and full pack

- Security features like secret phase verification, two-factor authentication, 3D Secure, Touch ID

9. Wirex

Wirex Visa card is a crypto card that enables you to operate crypto and fiat accounts, including converting crypto to fiat without third parties.

You can earn cashback as a reward when you purchase with this card. This crypto card also enables its users to operate multi-sig accounts.

Features:

- Supports over 36 cryptocurrencies and 150 fiat currencies

- Get 2% cash back on every purchase with the card

- Gives in-app alerts

- Save up to 3% on foreign transactions when you convert crypto to local currency at ATMs and merchant stores

10. TenX

The TenX crypto debit card enables you to spend Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) immediately at ATMs, merchant stores, and other stores that support Visa.

Its users can order the card through the TenX app. This card takes 7 to 9 days for users in EU/EEA to receive it, while it takes a maximum period of 5 weeks for users with APAC addresses to get the card.

TenX users must top up their cards with crypto to spend crypto with the card.10

Features:

- Can be funded only with crypto

- Real-time in-app notification

- Track your expenses in real time on its mobile app

Frequently Asked Questions (FAQs)

Should I Get A Crypto Card?

Crypto credit or debit cards are suitable for regular crypto users because they enable you to immediately convert Bitcoin and other cryptocurrencies to fiat at ATMs and merchant points that accept Visa and MasterCard.

Is There A Crypto Credit Card?

Crypto credit cards enable an easy connection between people’s bank accounts and crypto accounts. A

Gemini crypto credit card offers 2% cashback on every purchase, which users receive in the form of Bitcoin. The BlockFi Bitcoin credit card is another crypto credit card in which users can earn up to 1.5% cashback in Bitcoin for every purchase.

Therefore, you can easily pay for products and services at stores that do not accept crypto payments.

Conclusion

Interest in cryptocurrency is gaining significant traction as many people now understand its prospect and features. The innovation of some top cryptocurrency credit/debit card providers has further enhanced the adoption of crypto assets as a viable payment method, even when ATMs or merchant stores do not support them.

However, it is important to understand the features and fees of each of these providers to inform your decision on which is the best for you.